Solvency Ratios:

Unveiling financial health status of the company as it enlights an insight into the present and future position of the company. Solvency Ratios measure how well a company’s cash flow can cover its Long–term debt. A solvency ratio indicates whether a company cash flow is sufficient to meet long-term liability. Solvency Ratio is often used for evaluating a company’s credit worthiness as well as by potential investors. Like other financial ratios, solvency ratio often holds most value when compared over time or against other companies.

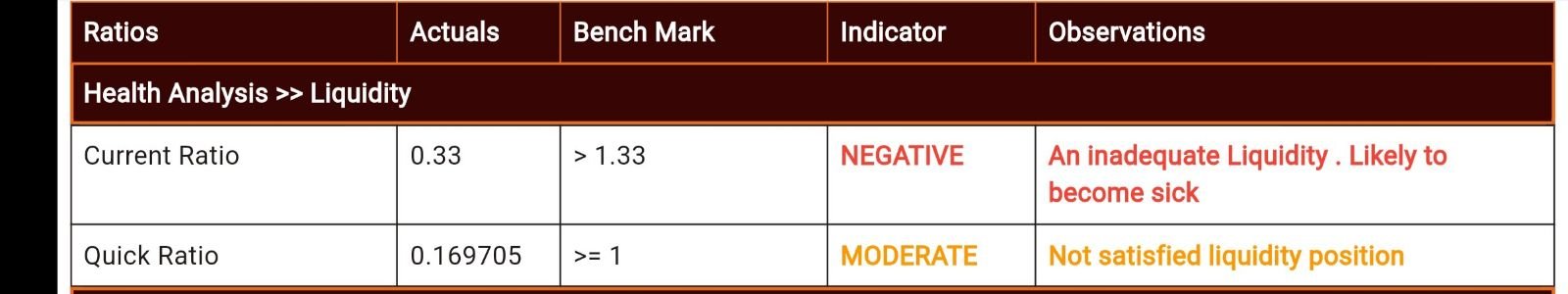

Liquidity Ratios:

Liquidity Ratios measures used for determining a company’s ability to pay of its short – term debts. In other words, this ratio tells how quickly a company can convert its current assets into cash so that it can pay off its liability on a timely basis. It is an important class of financial metric used to determine a debtor’s ability to pay off current debt without rising external capital.

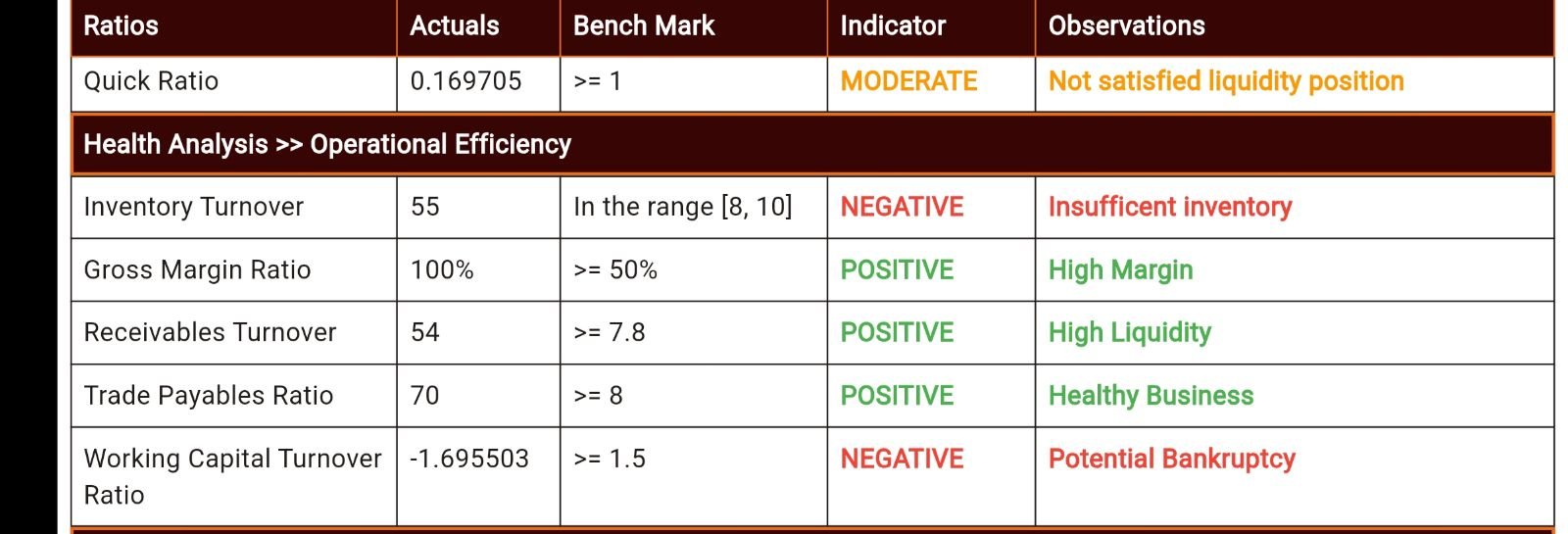

Operational Efficiency:

Operational Efficiency measures how company can reduce its resources usage to profit effectively; Factor that impact operational efficiency includes resources utilisation, manufacturing and inventory management. The Operating Ratio shows the efficiency of a company’s management by comparing the total operating expenses of a company to net sales.

The shareholders of the company are being kept in dark on the financial irregularities of the companies and that has been influencing further economic decision of the investors. The reporting of financial irregularities of the company in the financial analysis report will be a preventive measure in the hands of the investors to safeguard their interest from financial frauds.

Financial analysis of companies’ profitability helps in determining the financial performance of business at the end of an accounting period. Profitability metric can use to measure and analyse the financial Health of a companies. This might mean looking at the companies’ profits relative to its operating cost, shareholder equity, and revenue and balance sheet assets over a specified time frame.

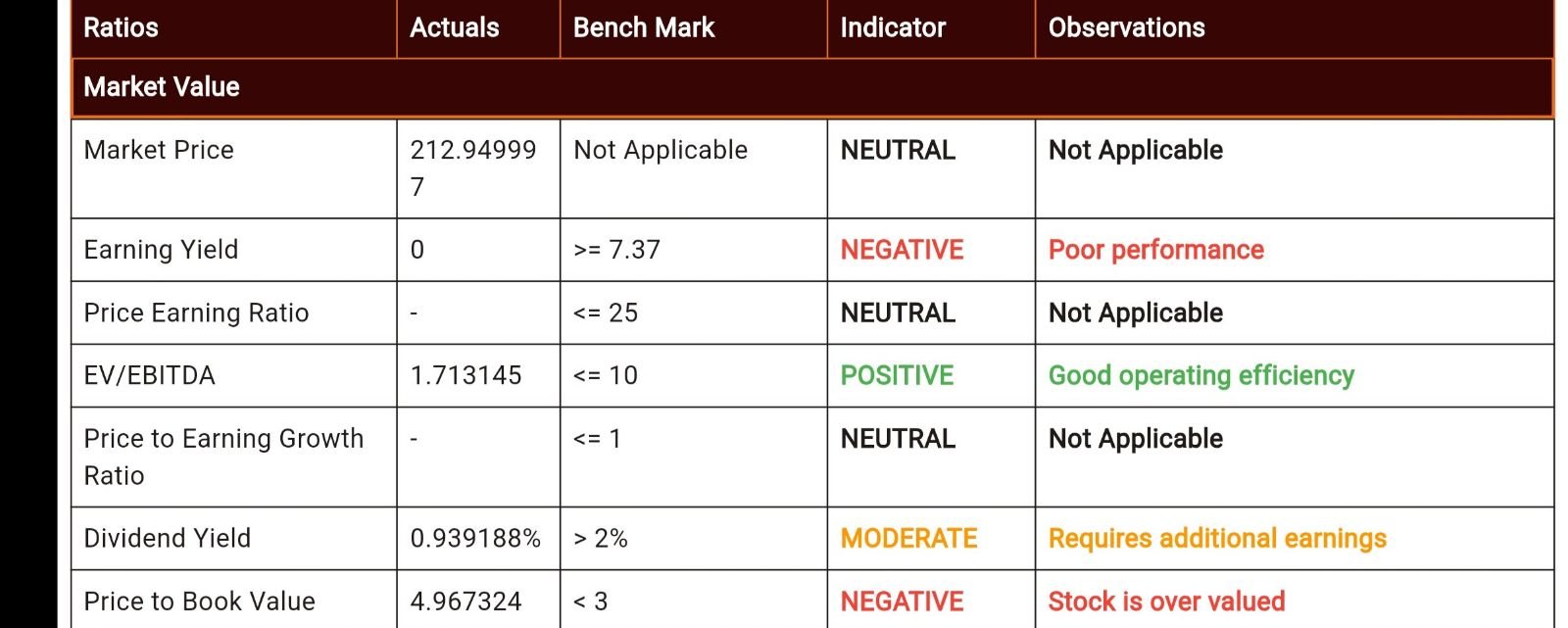

Market value Ratios are financial metric that measure and analyse stock price. And compare market prices. This ratio tracks the financial performance of listed companies to understand their position in the market. Through the Market Value ratio, you can determine whether the stocks of a particular company are overvalued, undervalued or rightly valued and optimal price at which the share should be bought or sold.

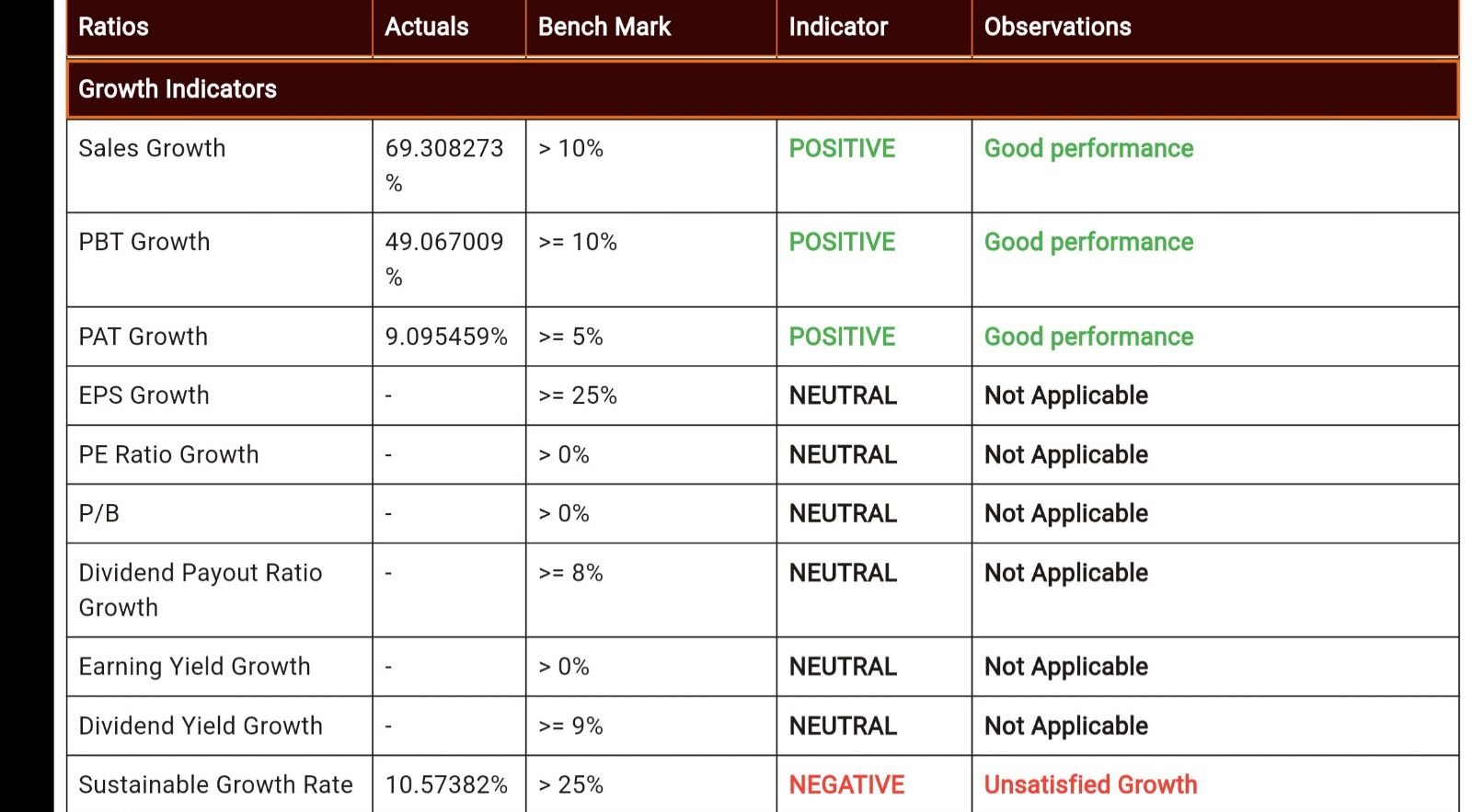

Growth indicator refers to the increase in a company’s size, revenue, market shares, customer demand and profitability over a time. This ratio track companies performance. They can rate and compare one company against another company that you might be considering investing in.